Pradhan Mantri Vaya Vandana Yojana Pension Scheme: Check PM Vaya Vandana Yojana Scheme Benefits, Eligibility

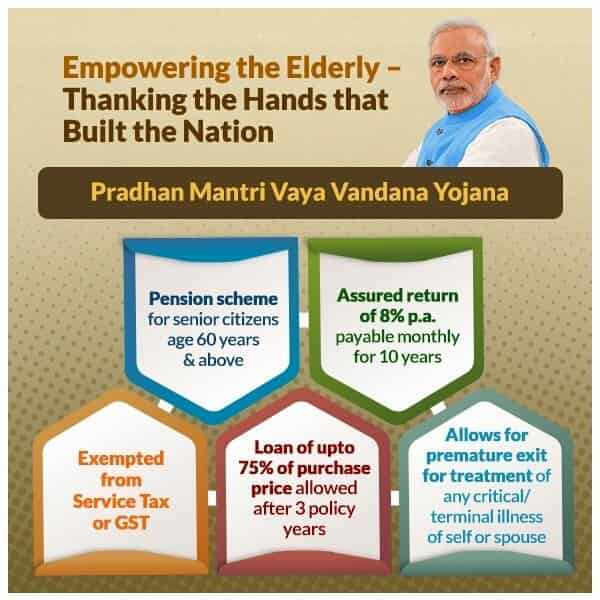

Pradhan Mantri Vaya Vandana Yojana (PMVVY) Pension Scheme was released in May 2017. `Pradhan Mantri Vaya Vandana Yojana’ (PMVVY) Pension Scheme is a type of pension scheme for retired senior citizens. Pradhan Mantri Vaya Vandana Yojana (PMVVY) Pension Scheme is managed by LIC (Life Insurance Corporation). Persons who are 60 years old can avail of this Pradhan Mantri Vaya Vandana Yojana (PMVVY) Pension Scheme till 31 March 2020. This works well for saving senior citizen from the unpredictable market situation as well as it offers economic security.

What is the Pradhan Mantri Vaya Vandana Yojana (PMVVY)?

Indian Government announced Pradhan Mantri Vaya Vandana Yojana (PMVVY) Pension Scheme for retirement that was launched in May 2017. When purchasers of the Pradhan Mantri Vaya Vandana Yojana (PMVVY) Pension Scheme invest their money, it called purchase cost. It assures the rate of return on the investment process. Pradhan Mantri Vaya Vandana Yojana (PMVVY) Pension Scheme pays pension that may be monthly or yearly. This way is excellent for traditional bank deposits.

The Government of India has promised to pay an 8% monthly rate of interest that would be up to 8.30% yearly rate for almost 10 years. A few times ago, the Indian Government fixed the annual rate of return at 7.4% for the year 2020-2021. Pradhan Mantri Vaya Vandana Yojana (PMVVY) Pension Scheme pays you a guarantee pension if you are a senior citizen. Also, it is the best scheme because it provides you high return as compared to other banks.

What is the eligibility for Pradhan Mantri Vaya Vandana Yojana (PMVVY) Pension Scheme?

There are no age criteria or fixed eligibility but this scheme admits the subscriber who is more than 60 years old or senior citizen. Apart from that, it will offer you advantages only if you are an Indian Citizen. The subscriber must be available to avail of this policy until 10 years. The minimum and starting purchase cost is 1.5 lakh with a monthly pension of Rs 1000.

Moreover, the maximum and high purchase cost is 15 lakh that offers a monthly pension of Rs 10000. So there is no specific entry age for taking the benefit of Pradhan Mantri Vaya Vandana Yojana (PMVVY) Pension Scheme. While you are choosing the amount of pension, make sure you first choose your family size.

What documents you must have if you are going to apply for Pradhan Mantri Vaya Vandana Yojana (PMVVY) Pension Scheme?

Under the Pradhan Mantri Vaya Vandana Yojana (PMVVY) Pension Scheme, you must have some documents that are mentioned below-

- Age proof

- Adhaar card

- Address detail

- One or two Passport size photo of the applicants

- The document of the applicant must indicate that you are retired from employment

How you can take benefits from Pradhan Mantri Vaya Vandana Yojana (PMVVY) Pension Scheme?

You can easily apply for Pradhan Mantri Vaya Vandana Yojana (PMVVY) Pension Scheme but you need to follow some procedure given below-

- Online application procedure

- Log In to the official LIC website

- Choose pension plan and proceed for further process

- Fill the application form correctly

- Now click on Submit button as well as upload the documents that are required

- Offline application procedure

- Get the PMVVY application form offline from nearby LIC branch

- Now fill the application form with correct and authentic detail

- Now submit the filled form and attach the required documents in hard copy

What are the advantages of the Pradhan Mantri Vaya Vandana Yojana (PMVVY) Pension Scheme?

- Pradhan Mantri Vaya Vandana Yojana (PMVVY) Pension Scheme offers you reliable return at the rate of 8% to 8.30% for approximately 10 years.

- The amount is paid out once a policy term of 10 years is completed.

- Purchase cost up to 75% is availed after 3 years to overcome emergencies

- The applicant can also withdrawal 98% of purchase cost due to medical emergencies

- If any applicant expired during the term of the policy, then-nominee will be paid out with the same purchase cost.

Table of Contents