Your credit score is a three-digit number from 300 to 850 indicating if lenders see you as a responsible borrower. The higher the score, the lower lending risk you represent. This impacts getting approved for loans or credit cards and the interest rates charged.

Landlords and insurers may check scores too. With the average US credit score at 704, good credit is key for the best rates and terms.

Understanding Credit Scores

Your credit score is a three-digit number ranging from 300 to 850 that indicates your creditworthiness to lenders and creditors. The higher your score, the lower the lending risk you present. This affects whether you can get a loan or credit card and the interest rates you will pay.

Landlords and insurers may also check your credit score. With the average credit score in the US being 704, maintaining a good score is vital for accessing the best rates and terms.

Importance of Credit Scores

There are numerous ways to check credit score, from free yearly reports to online sites showing real-time updates. Your number shapes your financial life:

- Loan approvals: Lenders review scores when deciding yes or no for home, car, or personal loans. Higher scores often mean better chances and terms.

- Interest rates: Good credit scores qualify borrowers for lower rates on mortgages, saving thousands over the lifetime of the loan.

- Insurance costs: Car and home insurers may raise premiums for those with poor scores, seeing them as riskier. Good credit score of 711 secures lower rates.

- Renting homes: Landlords screen applicant credit scores as part of process. Bad or limited history makes renting harder.

- Utilities: Some cable, phone and utility companies need credit checks and may request deposits for new accounts if your score is low.

- Jobs: Though illegal in some states, a few employers check scores and view low numbers as a sign applicants may be irresponsible or stressed financially.

In short, your credit score shapes your financial options significantly. Knowing your number is key for money health.

Credit Score Ranges and What They Mean

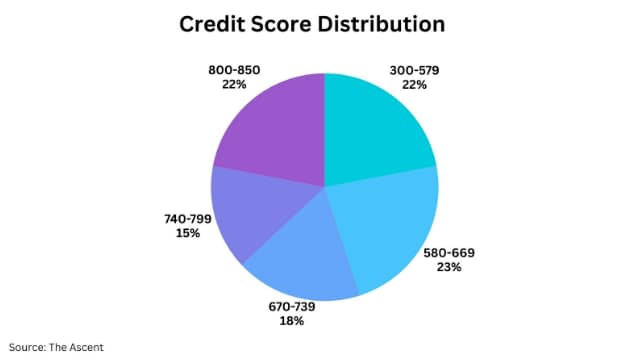

Scores generally fall into ranges giving insight on your creditworthiness and borrowing risk:

- Exceptional (800-850): Low default risk. Allows top rates from lenders plus approvals for premier cards/loans. Under 1% reach this top level.

- Very Good (740-799): Risk is well below normal. Qualify for excellent financing rates on big loans. Aim for this favorable group.

- Good (670-739): Seen as an acceptable borrowing risk overall. Get credit but may not always get rock-bottom interest rates or high limits.

- Fair (580-669): Default risk deemed above average. May struggle for approvals and pay higher financing rates. Building score recommended.

- Very Poor (300-579): Seen as well below trustworthy, with high default risk assumed. Hard to get approved for reasonable rates/limits if at all.

Checking your score regularly ensures you know your current status and if improvement is needed to reach a higher tier. Higher numbers unlock more financing options and potential savings.

FICO Score vs. VantageScore

The two most common credit scoring models are the FICO Score and VantageScore, both ranging from 300 to 850. FICO has been the industry standard for decades. But VantageScore has gained ground, especially in emerging credit markets.

While similar, they have some key differences in their formulas and the data used to calculate scores. Knowing which model a lender uses can provide insight into your approval odds.

Factors Affecting Credit Scores

Several big things decide your personal credit score:

- Payments on Time (35%): Paying bills when due matters most. Late payments badly hurt.

- Owe Compared to Limits (30%): Keeping balances small compared to your credit limits helps increase the score. High debt-to-limit signals risk.

- How Long Credit Used (15%): Having accounts open longer while in good standing raises your score.

- Types of Credit (10%): Having different kinds (cards, loans, mortgages etc.) shows responsible management.

- New Accounts Opened (10%): Opening many new accounts quickly can lower scores.

- Lower income people average 658, while upper income average 774, showing the link between money and scores.

Improvement and Maintenance of a Good Credit Score

Boosting your credit score takes diligence across factors like:

Pay All Bills On Time: Payment history has huge impact. Set up auto-payments and reminders to never miss deadlines.

Use Less of Limits: Keep debt low on each card and total. Pay more than minimum monthly. Ask for higher limits.

Keep Old Accounts Open: Let account history age by keeping old accounts open longer, especially the first one. Don’t close old, paid-off accounts.

Add New Credit Carefully: Open some new accounts over years. Too many new accounts and credit checks hurt.

Check Reports and Scores: Review reports from all 3 bureaus. Check personal scores monthly. Dispute any mistakes immediately.

Checking credit data is vital, yet 38% of young adults 18-24 never do. Monitor every 6 months to catch problems early. With responsible habits, you can build and keep strong scores long-term.

FAQs

What is the significance of having a good credit score?

Your credit score affects getting approved for loans, interest rates, rental applications, and other money opportunities. A higher number signals lower risk of not paying and unlocks the best rates and terms.

How are credit scores calculated and what factors influence them?

Scores like FICO and VantageScore consider payment history, amount owed versus limits, history length, mix of credit types, and new credit checks. How you manage these areas determines if lenders see you as responsible.

What are the differences between FICO Score and VantageScore?

While both range 300-850, FICO and VantageScore use somewhat different formulas and data to create scores. Lenders may rely on one model more. Knowing which is used helps understand approval chances.

Parting Thoughts

Your credit score level can really impact financial options now and later. By learning what shapes scores and building good credit actions deliberately, you pave the way toward better rates and money health long-term.

Checking credit, paying on time, keeping card balances low, and letting history age through time are key steps for anyone to take. Don’t get discouraged if progress is slow first – staying committed to responsible habits makes a difference.

With dedication over time, you can improve your situation. So start those good financial habits today!

Table of Contents